Az árupiacok további szárnyalása....

The soaring commodity markets, more investors expect the

2010th December 12 | 09:58 |

The pension funds, hedge funds and other institutional investors sounding opinion survey shows, investors expect the commodity markets, soaring further. The majority of those polled by Barclays Capital for further significant capital inflows, and rising rates matter mainly for industrial metals, grains and energy goods.

The Barclays Capital, 300 institutional investors, among them 120 and 120 hedge fund managers to pension fund manager interviewed for next year's investment várakozásaikról. The survey shows that investors still see potential for significant further increases in commodity and exposure in these markets. The three-quarter of respondents expect that next year another 50 billion dollars of capital can come from the commodity, which is close to, or perhaps even exceed this year's flow of funds - the type Ai tion.

The answers, it is clear that the anticipated yields are now needed to find the appropriate strategies as well. Therefore, investors are increasingly moving into an active investment strategy, as opposed to following the passive index investing. The respondents of the largest copper soaring to expect, but expect a big price rise of crude oil and grain market.

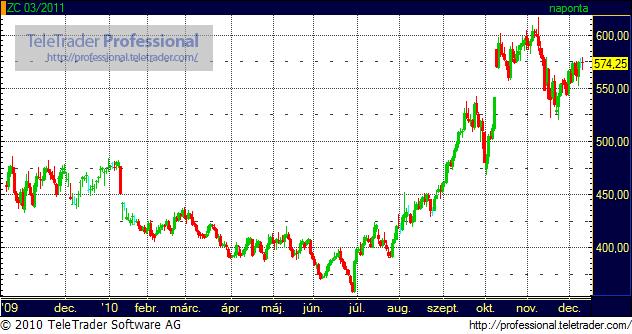

The March corn futures exchange rate

The raw materials also constitute a form of insurance protection and the economic and political shocks, as the physical products of practical usability of rising property matters - explains Brad Yim, a portfolio manager of Castlestone Management. Moreover, similar results obtained by Goldman Sachs Asset Management recently published survey, which concluded that since the credit crunch of the raw materials are less risky assets.

Címkék: Árupiac

0 megjegyzés:

Megjegyzés küldése

Feliratkozás Megjegyzések küldése [Atom]

<< Főoldal